AI Agents for Finance Operations

Accounts Payable Accounts Receivable Integrated Receivables Compliance Digital Mailroom Wholesale Lockbox

Live in production processing over 100,000 transactions daily — streamlining workflows, improving accuracy, and driving measurable profitability across customer ecosystems.

Driving value and profitability for Banks, Processors, and Corporate CFOs

Purpose-Built for Finance – Live with SLAs

Deployed in live environments with contractual SLAs, Itemize supports high-volume finance operations across banks, fintechs, and enterprises.

- Powering mission-critical workflows across AP, AR, Treasury, and Compliance

- Proven in real-world use cases – not test labs or sandboxes

- Scaling across teams and business units without added headcount or IT support

- Delivering reliable results with SLAs for accuracy, speed and scalability

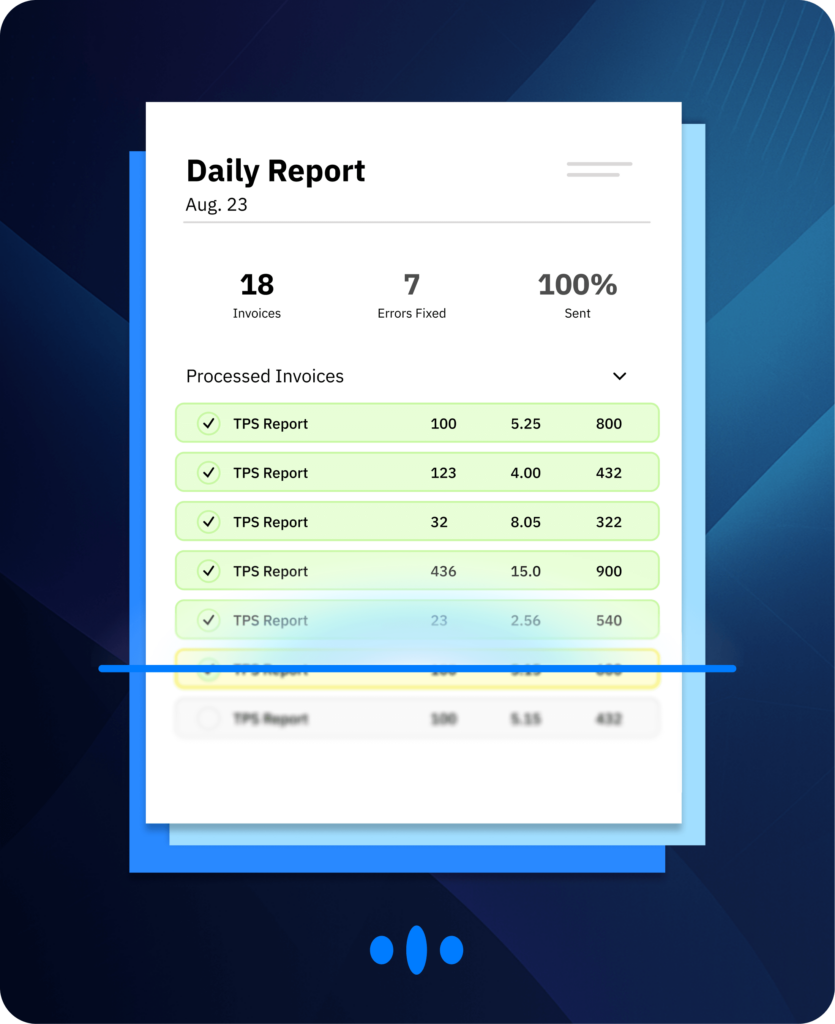

100% AI – No Humans

No shared service desks. No offshore teams. Just AI powering your team.

- Delivers 100% AI-driven automation – no humans in the loop

- Eliminates manual review queues, escalations, and delays

- Scales seamlessly without adding headcount or IT lift

Line-Item Automation

Every detail captured, classified, and actioned – at the line level.

- Processes transaction data line by line, not just at the header level

- Operates across AP, AR, procurement, and other finance functions

- Offers line-item level reconciliation and account coding

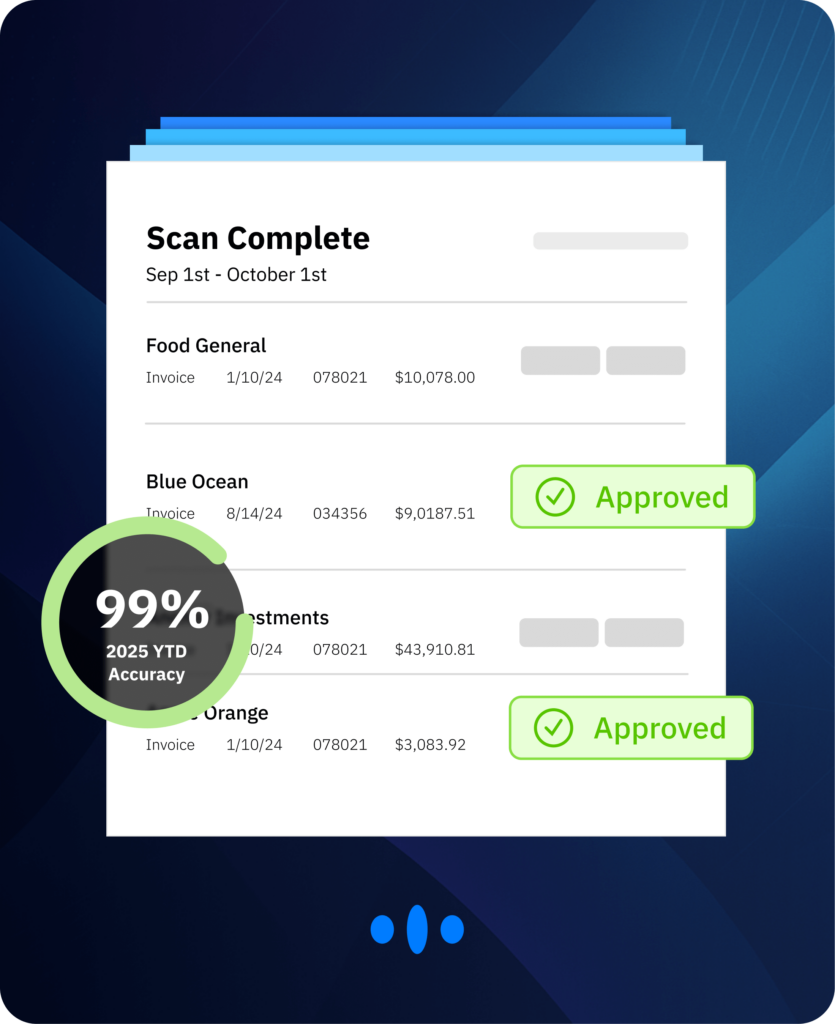

99%+ Accuracy and 0% Hallucinations

Field-level precision you can trust – no guesswork, no gaps, no generative noise.

- Delivers 99%+ accuracy with independently validated outputs

- Outperforms BPOs, OCR tools, and RPA in reliability

- Eliminates human error and AI hallucinations to ensure data integrity

- Provides confidence scoring, audit trails, and full compliance controls

Finance Operations Use Cases

For Banks and Processors

Itemize’s Agentic AI platform simplifies and accelerates high-volume transaction processing, reducing manual effort and increasing accuracy.

For Corporate CFOs

Itemize delivers the first Finance Operations Agents, designed to manage and automate complex finance functions with precision.

What we Automate

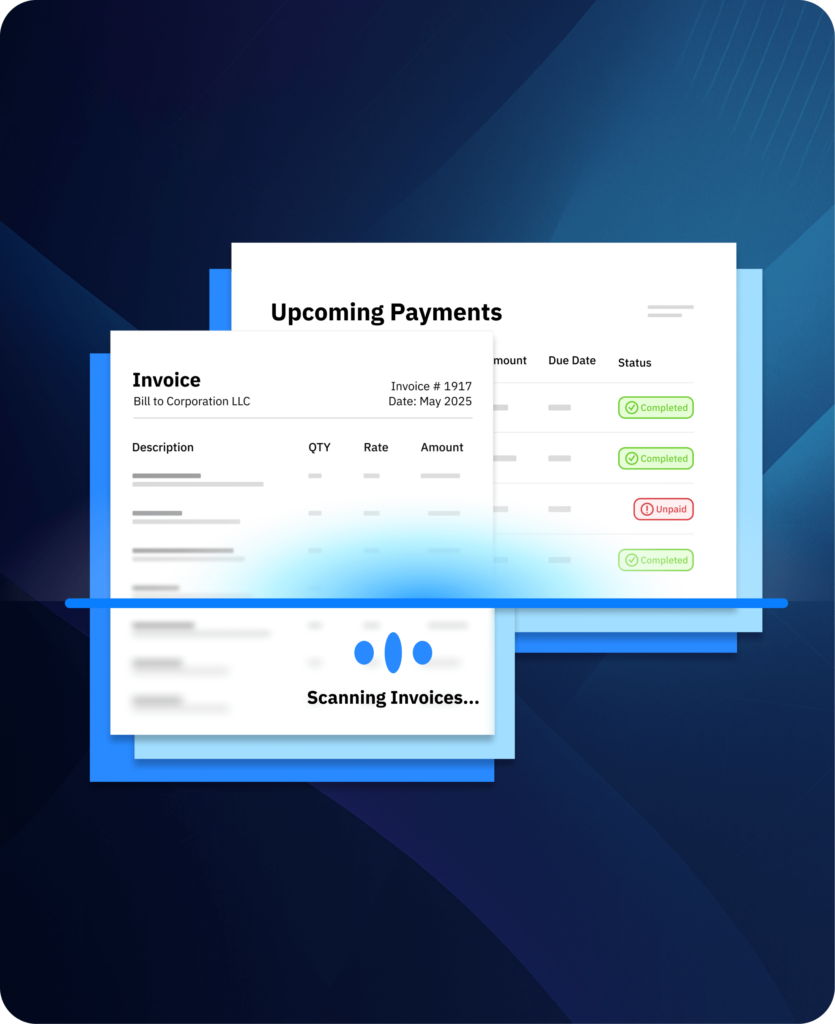

Line-Level Documents and Data Processing

From Raw Inputs to Structured Finance Data

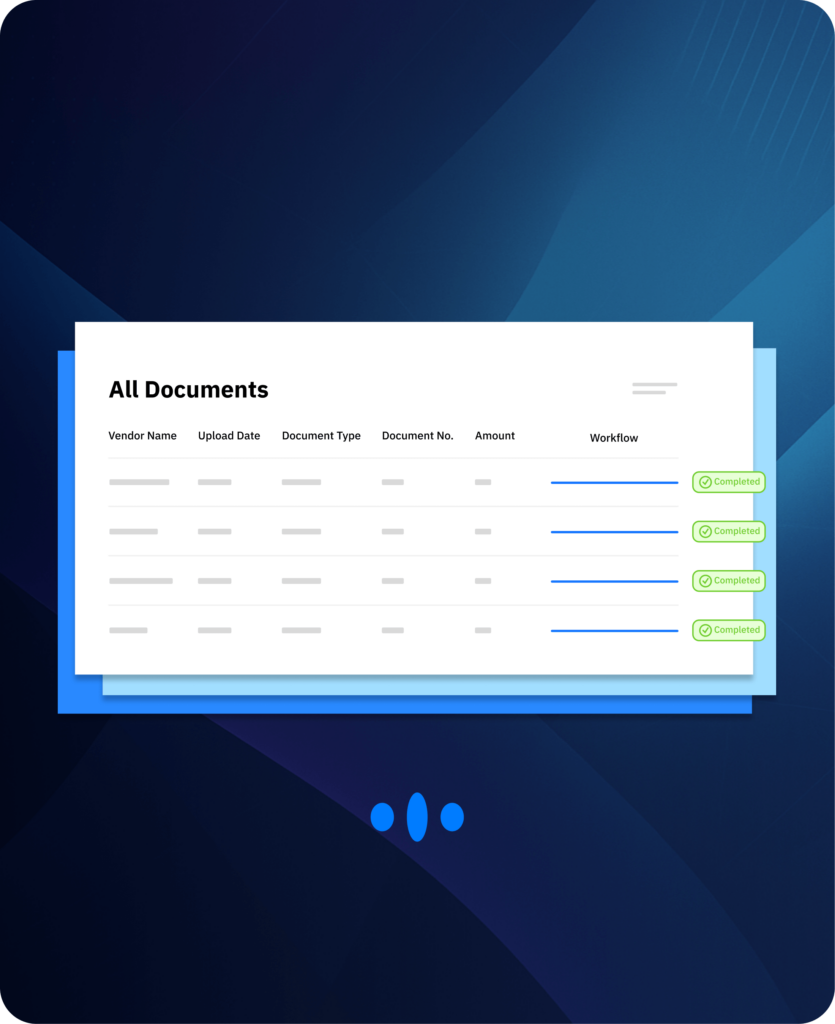

Itemize automates the end-to-end lifecycle of financial documents and data sets – capturing, classifying, and organizing clean data ready for automation. No templates. No manual keying.

- Transforms and integrates document data with diverse and custom data sets

- Enables workflows with “level three” line-item automation

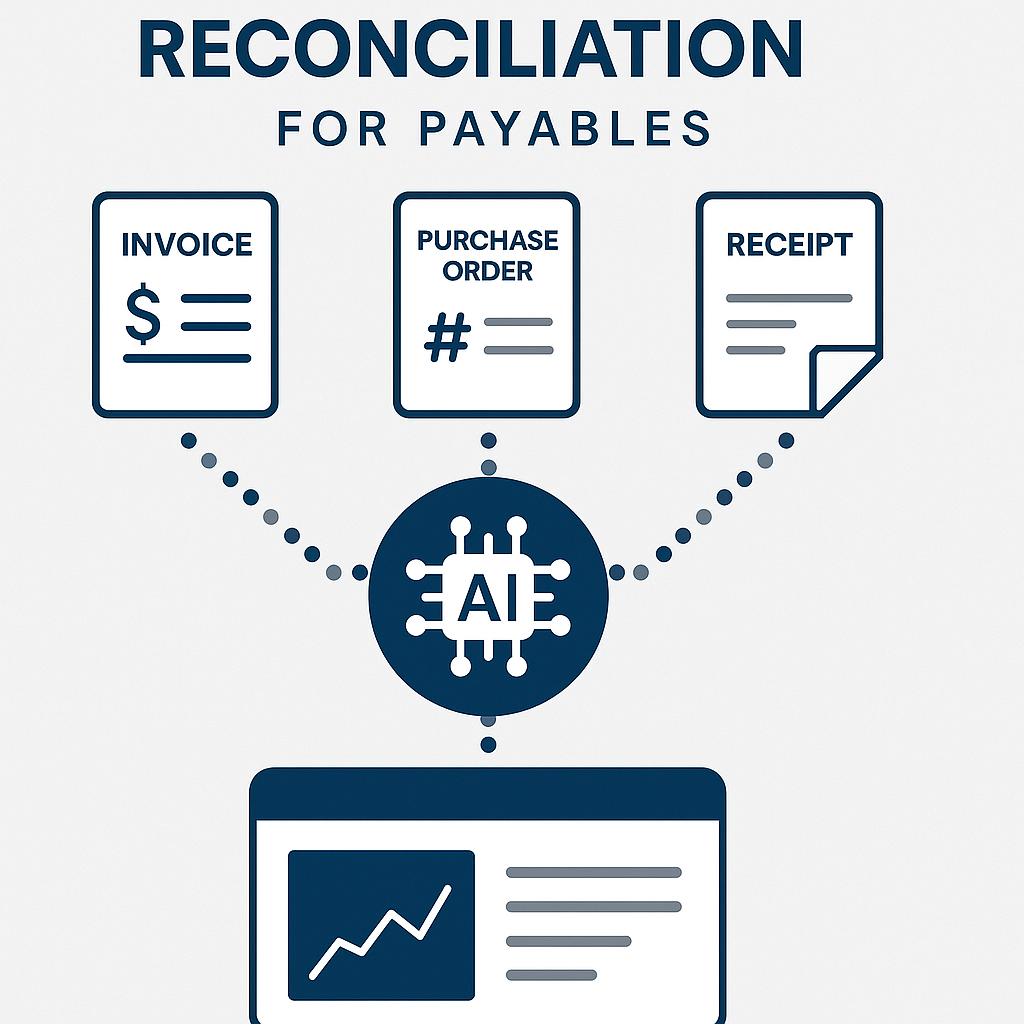

Coding, Matching, and Reconciliation

From Raw Line Data to Real-Time Execution

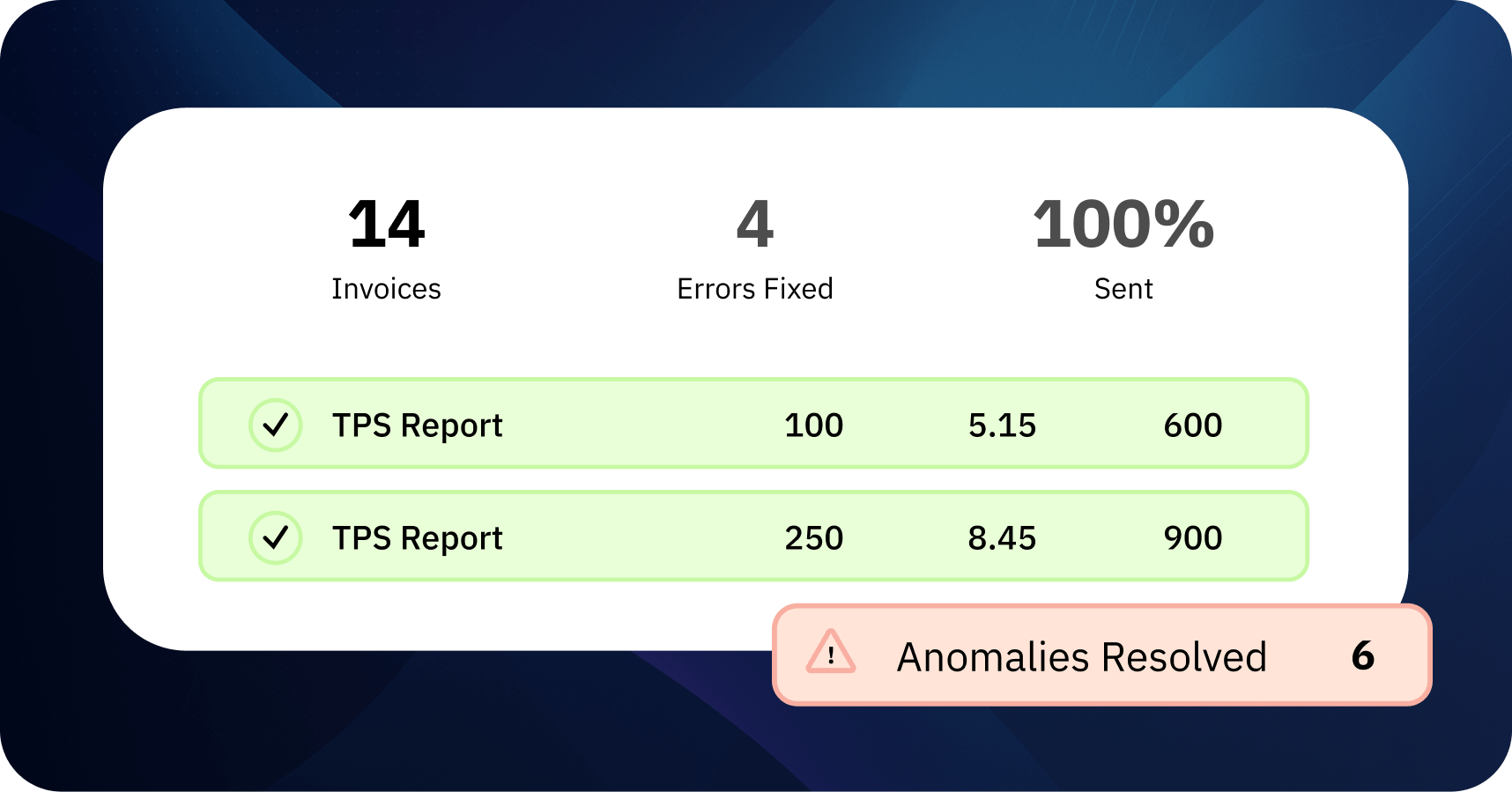

Itemize goes beyond extraction to deliver full finance transaction processing. Our AI Agents reason through line-level data to perform advanced tasks — from reconciliation and GL coding to exception detection and workflow automation. It’s live, operational, and integrated.

- Ingests finance documents and data, including mailroom prep

- Performs two-way and three-way line-item reconciliation

- Automates general ledger coding at the line-item level

- Flags duplicates and exceptions for early resolution

- Automates tasks including routing, redaction, and enrichment

Reporting and Forecasting

From Data and Actions to Real-Time Finance Intelligence

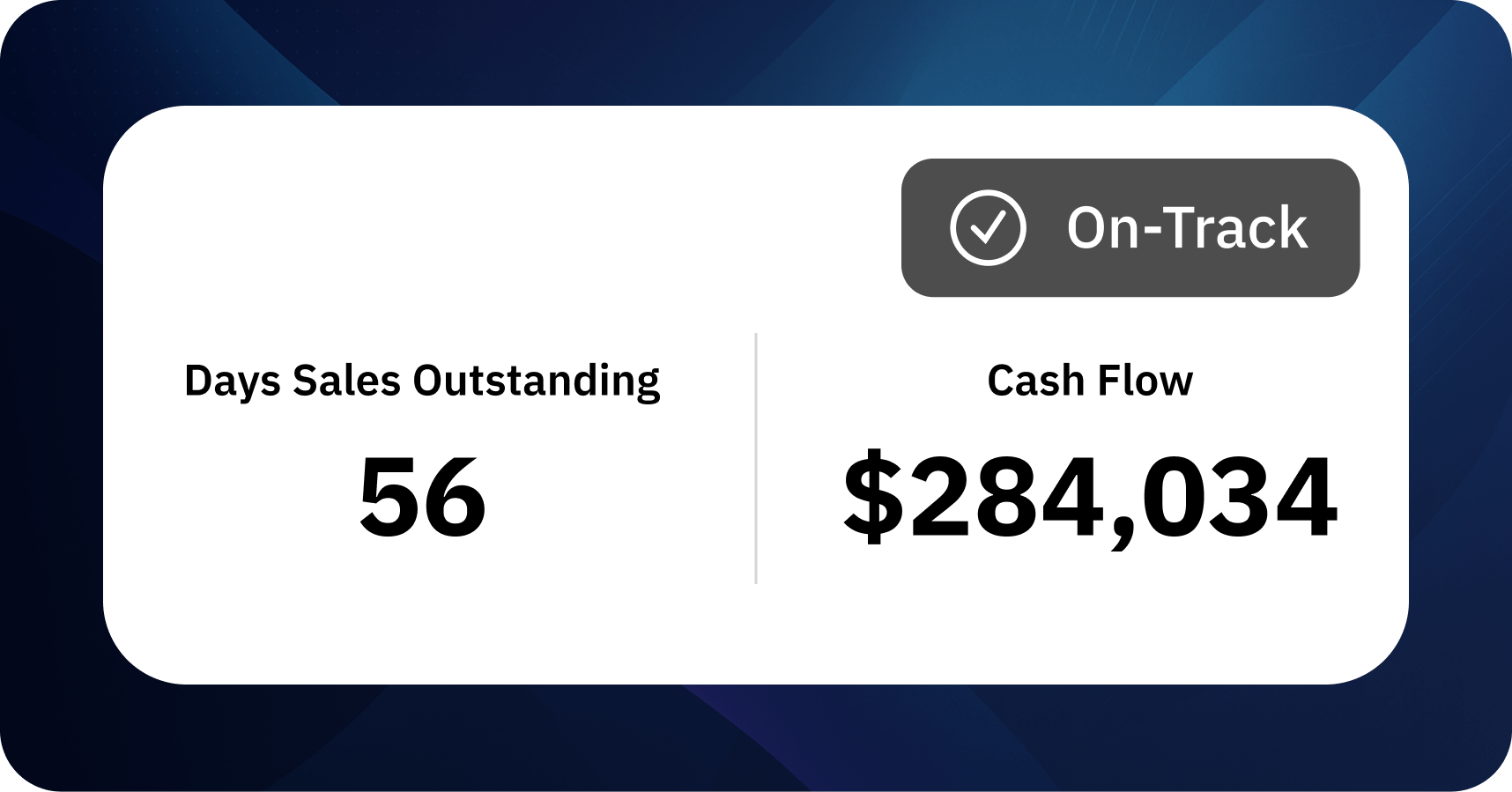

Itemize connects documents, intelligence, and workflows to surface insights that drive action. AI Agents analyze real-time data to spot trends, project future outcomes, and empower CFOs with visibility and control.

- Delivers real-time visibility into line-item level payables and receivables activity

- Generates predictive insights from itemized data

- Delivers dynamic dashboards built on granular intelligence

- Supports faster decisions around payments and cash flow

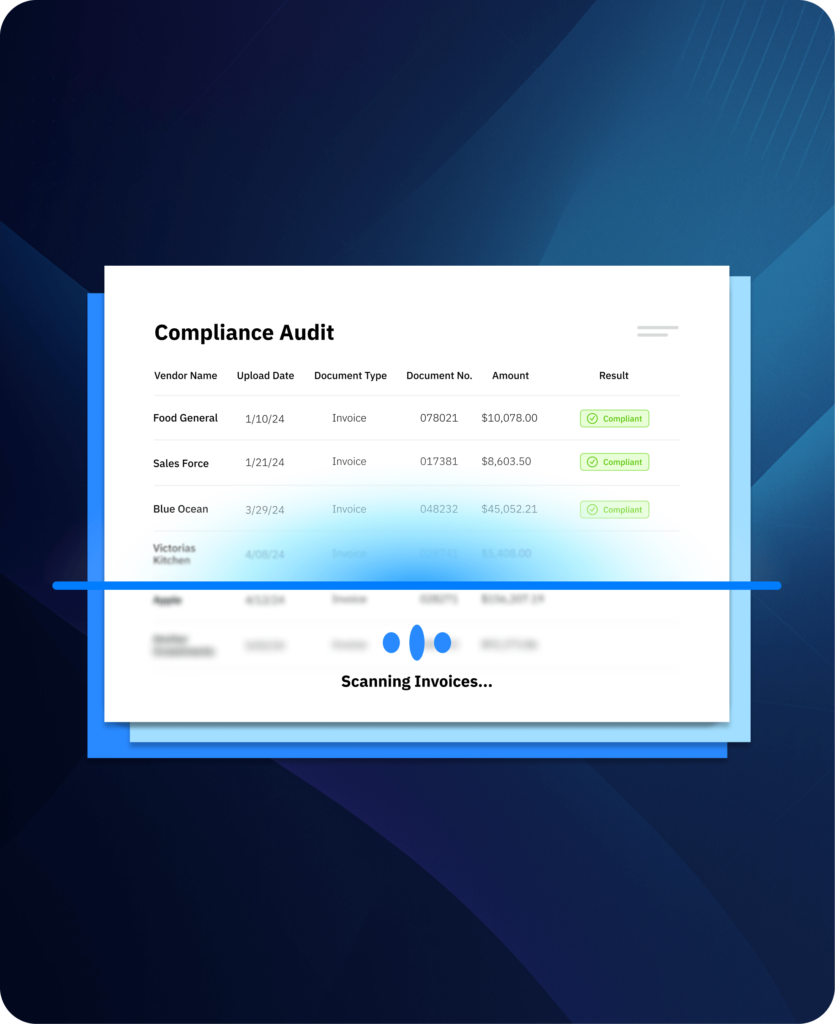

Compliance, Fraud, and Audit

From Unstructured Inputs to Trustworthy, Audit-Ready Records

Itemize enables automated controls across documents and workflows — detecting fraud, enforcing compliance, and preparing organizations for audits. AI Agents validate inputs, monitor for anomalies, and maintain detailed audit trails.

- Continuously checks for policy violations, fraud indicators, and duplicate activity

- Enforces compliance rules at the document and transaction level

- Creates a complete, time-stamped audit trail for every action

- Equips Compliance with searchable logs and exception reports

Built for CFOs and Operations Leaders

Deliver Quality

Ensure over 99% field-level accuracy with AI-driven automation – eliminating manual errors, reducing exceptions, and driving end-to-end reliability across financial workflows

Reduce Costs

Save up to 50% by replacing manual processes with intelligent line-item automation that streamlines operations without increasing headcount or IT overhead

Improve Capital Efficiency

Accelerate cash flow by shortening the time from invoice to payment and boosting straight-through processing — optimizing working capital and reducing days sales outstanding (DSO)

Working Capital and Liquidity

Gain real-time visibility into payables and receivables, enabling more informed treasury decisions, better liquidity planning, and enhanced cash positioning

Gain Intelligence

Extract and classify every line item across complex financial documents – enabling granular analytics, automated compliance checks, and actionable business insights

AI Agents for Banks and Processors

Receivables Automation

Streamlines payment capture and remittance matching to accelerate cash posting.

Payables Processing

Automates invoice intake, validation, and approvals to improve STP and reduce costs.

Wholesale Lockbox

Transforms lockbox documents into structured data for faster receivables processing.

Healthcare RCM

Reconciles EOBs, claims, and remittances to accelerate revenue cycle workflows.

Digital Mailroom

Digitizes inbound documents for real-time routing and workflow automation.

Compliance and AML

Automates document checks and anomaly detection to support KYC and AML protocols.

AI Agents for Corporate CFOs

Accounts Payable

Automates invoice capture, coding, and exception handling to streamline AP ops.

Account Receivables

Accelerates cash application by matching payments and remittances with precision.

Integrated Recievables

Consolidates receivables data across sources to drive visibility and control.

Digital Mailroom

Centralizes document intake for faster processing across finance workflows.

Spend Analytics

Delivers line-level insights into spend patterns for smarter decision-making.

Cash Flow Forecasting

Generates dynamic AI powered cash forecast from transaction data.

Impact for Customers

Hours Saved per day

average customer ROI

Daily Liquidity Acceleration

Industry Solutions

AI-Driven Document Processing for Financial Transactions

Itemize helps banks and processors automate high-volume document workflows, improving STP rates across receivables, payables, lockbox, deposit operations.

- Automates validation, reconciliation, coding, and redaction

- Processes related supply chain and compliance documentation

- Digitizes paper, email, and scanned documents at scale

Solutions: Wholesale Lockbox, Digital Mailroom, Receivables Processing, Payables Processing, Healthcare RCM

Scalable AI for Finance Document Automation

Fintechs and software firms embed Itemize APIs into their platforms and services to deliver item-level document automation.

- Enables embedded workflows for B2B applications

- Delivers real-time document processing at scale

- Integrates seamlessly with internal and client-facing systems

Solutions: Wholesale Lockbox, Digital Mailroom, Receivables, Payables, T&E, VAT, Healthcare

Streamline Project Finance with AI-Powered Automation

Handle high volumes of invoices, subcontractor payments, and job-related expenses with ease. Itemize automates end-to-end AP, AR, and integrated receivables while improving visibility into spend across multiple sites and vendors.

- Extracts and reconciles remittances and payments

- Consolidates spend across suppliers, jobs, and regions

- Centralizes document flow with a digital Digital Mailroom

Solutions: AP, AR, Integrated Receivables, Spend Management, Digital Mailroom

Power Financial Automation Across the Supply Chain

From procurement to plant operations, Itemize helps manufacturers eliminate manual processing and gain tighter control over vendor payments and customer receivables.

- Reconciles line-level data from POs, packing slips, and bank files

- Tracks spend by facility, product line, or cost center

- Digitizes incoming financial documents with Digital Mailroom

Solutions: AP, AR, Integrated Receivables, Spend Management, Finance Mailroom

Simplify Complex Workflows and Carrier Transactions

Logistics companies manage diverse vendors, fuel charges, freight bills, and purchase orders. Itemize automates finance tasks to reduce bottlenecks and improve turnaround.

- Extracts and reconciles BOLs, freight invoices, and remittances

- Automates spend classification across routes and carriers

- Centralizes financial document intake with digital mailroom

Solutions: AP, AR, Integrated Receivables, Spend Management, Digital Mailroom

Accelerate Finance Ops Across Stores and Channels

Retailers benefit from touchless document processing and real-time financial data. Itemize helps finance teams keep up with thousands of transactions, suppliers, and SKU-level spend.

- Extracts data from POS settlements and payment records

- Flags anomalies and outliers in supplier spend

- Digitizes inbound financial documents from all channels

Solutions: AP, AR, Integrated Receivables, Spend Management, Digital Mailroom